The business landscape in 2023 and beyond can be overwhelmingly competitive — and that’s where private equity (PE) firms can make a difference. Over the past few years, private equity value creation has become a critical business contributor. An expert private equity firm can provide value and capital growth for a wide range of business models and companies. PE firms benefit businesses of all shapes and sizes, from local tech start-ups to global corporations.

The total global private capital generated by private equity firms reached $1.3 trillion in 2022, according to the latest data from Preqin. Add that sum to the capital generated by PE firms from 2018 to 2021, and we get an impressive $6.4 trillion raised over a five-year period. To fully comprehend the implications of the value of private equity in a company, it’s important to first understand what private equity is, how it creates value, and what it means for businesses and industry sectors in 2023 and beyond.

In this article, we’ll discuss the following points about private equity value creation:

- How Private Equity Works

- The Private Equity Deal Process

- The Main Mechanisms of Private Equity Value Creation

- Private Equity Value Creation in 2023

- The Impact of Private Equity on Software and Technology Companies

How Private Equity Works

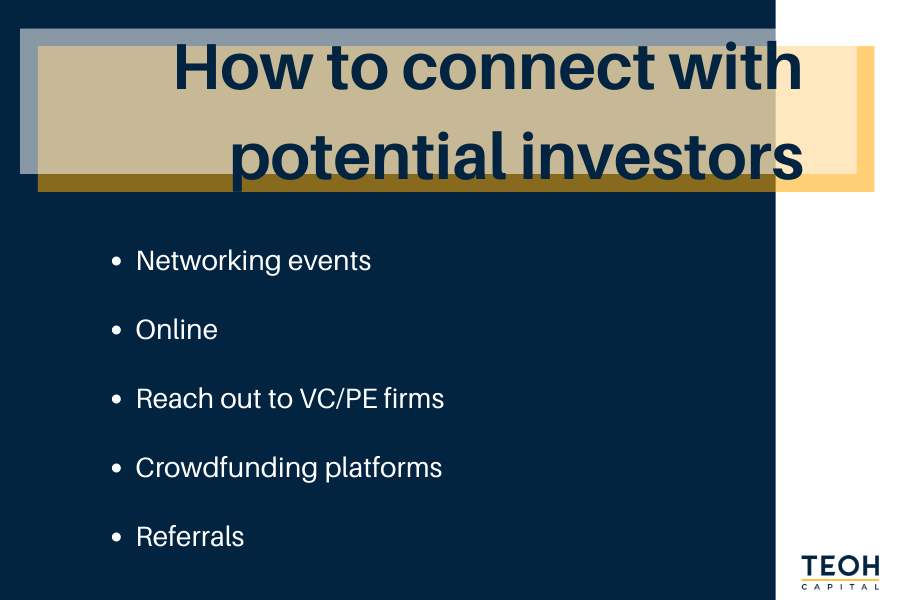

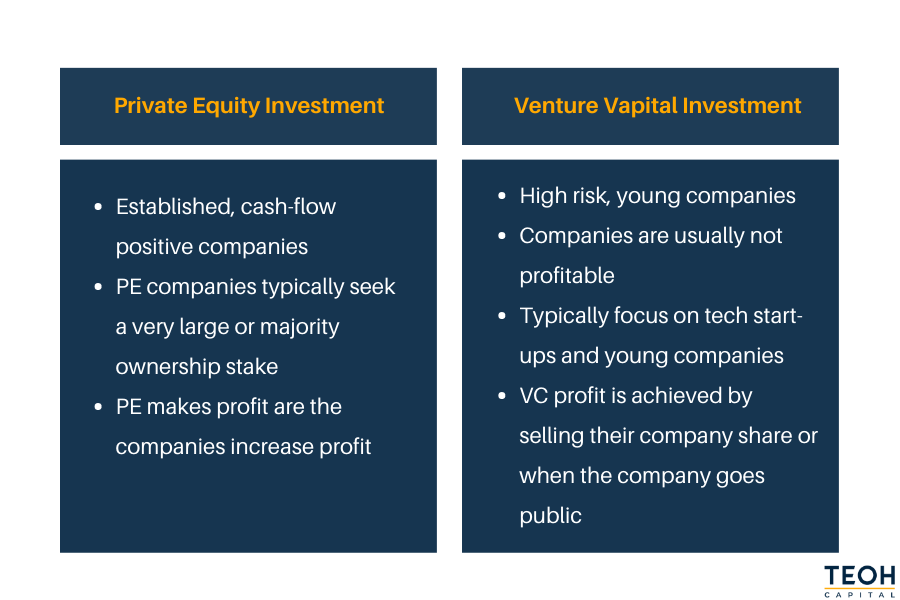

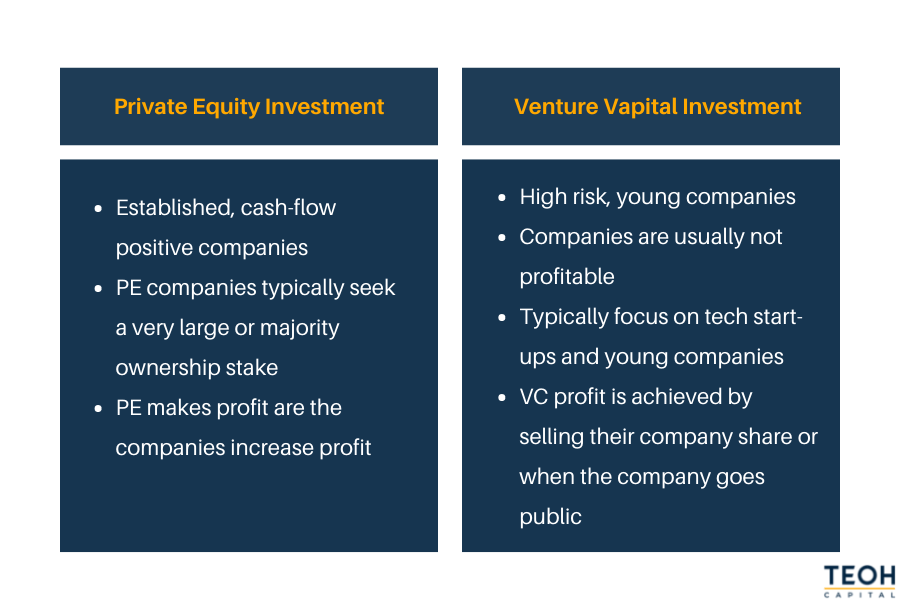

Private equity is a source of investment capital that refers to the ownership or interest in an entity that isn’t publicly listed or traded on a stock exchange. PE firms take capital from investors and raise funds. They use their capital to invest in and acquire businesses. Depending on their investment philosophies, PE firms can bring value beyond the monetary to companies they invest in and acquire, such as:

- Industry knowledge and connections

- Talent acquisition

- Strategic direction and guidance

- Operational expertise

- Expanded reach and market

- Capital injection, business growth, and overall profitability

The primary motivation for businesses who partner with PE firms is a positive return on investment (ROI) — this can be achieved with private equity firms, which can yield favourable returns for shareholders. Private equity usually comes with an investment horizon of between 4 to 7 years — meaning PE firms are focused on investing in companies to provide substantial returns in a long-term time frame. As such, PE firms usually only invest in companies they see great potential in.

The Private Equity Deal Process

Typically, the private equity investment process involves four key stages. Not every PE deal follows this exact process, and there are a lot of different steps involved in each stage, but if you’re approaching or considering a private equity deal, this is what you can expect:

- Sourcing— when the firm identifies the businesses for investment. PE firms often choose a winning sector early in its development or an underperforming company they plan to build up.

- Acquisition— when the firm acquires the business. A non-disclosure agreement (NDA) is signed, and due diligence is conducted, after which an investment proposal and a non-binding letter of intent (LOI) are presented. An internal operating model and a preliminary investment memorandum are created and reviewed.

- Management— the firm actively manages the business to increase value, using its knowledge, leverage, financial strategies, and connections.

- Exit— after a period of time, usually between 4 and 7 years (depending on the profits and agreed holding period), the firm sells the business for a significant profit. The time in which the funds are returned to investors is known as the harvest period.

The Main Mechanisms of Private Equity Value Creation

Each firm may operate differently, but these are the three key areas that private equity firms focus on for value creation in a company:

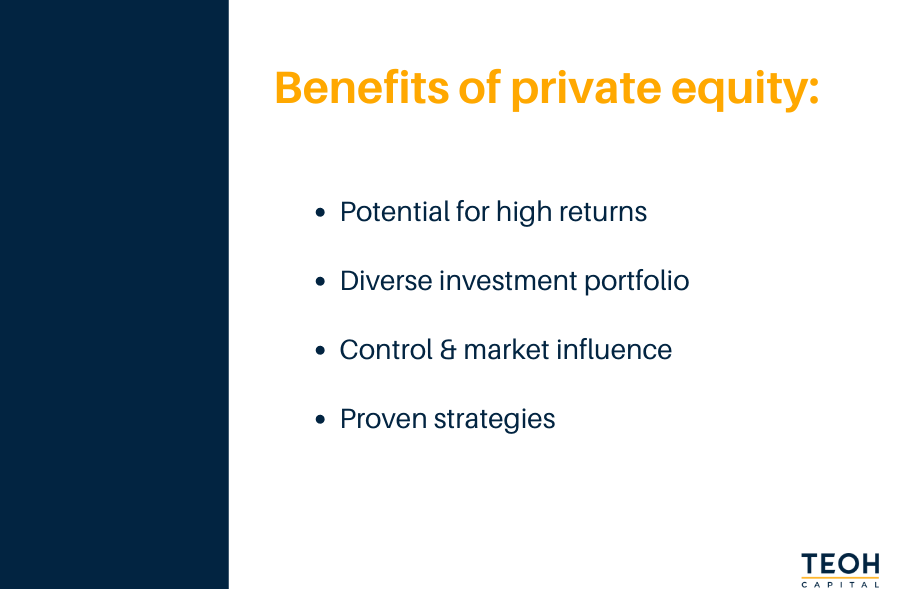

Operational Efficiency

Using their industry knowledge and expertise, PE firms manage businesses by improving their operational efficiency. Reducing costs and optimising resources can increase the business’ overall profitability.

Strategic Growth

By identifying and actively pursuing growth opportunities, PE firms can expand the business to new markets, develop new in-demand products, and pursue further strategic acquisitions. For example, a software company could partner with a PE firm to expand into additional geographical locations, boosting sales and driving revenue growth.

Financial Engineering

PE firms optimise the capital structure of a business through financial engineering and debt leveraging. They can also improve shareholder value through share buybacks or dividend payouts. PE firms can also source deals by building relationships with mergers and acquisitions intermediaries and investment banks to expand and manage their portfolio companies.

Private Equity Value Creation in 2023

Private equity firms continue to source, manage, and raise assets and sums of incredible value. There were $11.7 trillion worth of private market assets under management (AUM) by the end of the 2022 financial year. Assets under management account for the total value of assets managed by a private equity firm, including the assets that PE firms invested in and the assets they raised from investors. The $11.7 trillion sum was an 8.4% increase from the AUM held in 2021 and a considerable increase from the assets held by private equity (PE) firms in 2019, which was just $3.9 trillion.

As we advance towards the end of the 2023 financial year, the future of private equity is expected to grow further. The return on investment for the average business partnering with a PE firm is also expected to remain strong. Even though private equity assets experienced a slowdown in the second half the 2022 financial year, the overall trends still demonstrate substantial growth at noticeably rapid rates.

As the business world grows more challenging — for newer businesses and long-standing companies alike — private equity firms pose more relevant and lucrative business opportunities than ever before. Thanks to the increased globalisation of the market, the growing prevalence of technology, and the rise of alternative asset classes such as hedge funds, real estate, and private equity, there are infinite opportunities for private equity firms to create value in a company. This makes PE firms an ideal solution to the struggles and challenges of the 21st century economy.

The Impact of Private Equity on Software and Technology Companies

Private equity firms — especially in recent years — play a prominent role in economic growth. The value created by private equity firms drives business expansion, creates jobs, and stimulates innovation through investing in businesses with novel technologies and business models. The entire cycle of a private equity deal can generate large returns for investors and significant capital growth for the company.

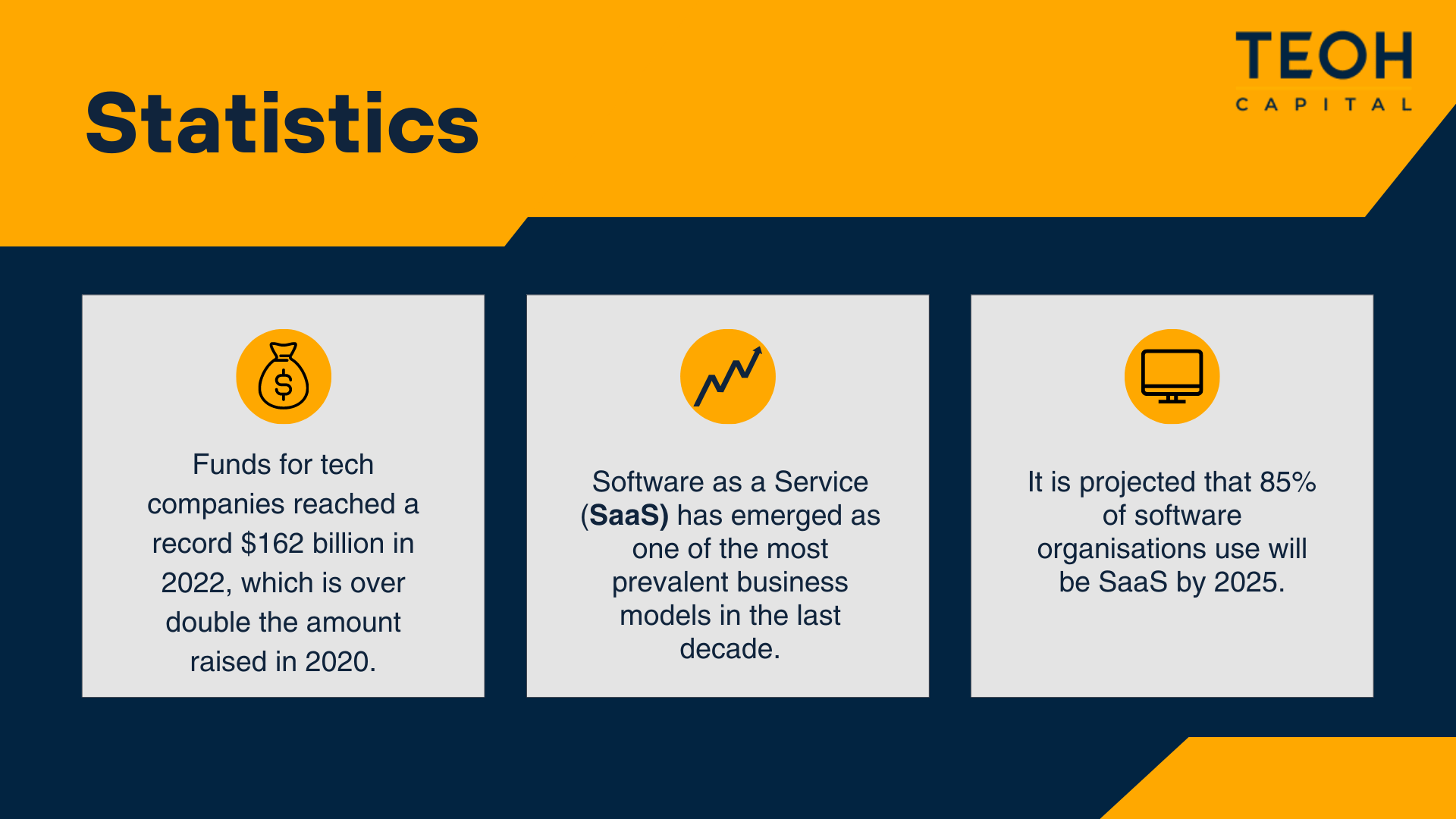

Moving ever further into the 2020s, private equity firms contribute significantly to the growth of the software and technology sector. A large portion of the assets under management over 2022 by private equity firms were from software companies — and almost 30% of all global buyout deals came from the technology and software sector (private equity value’s most significant contributor over the past few years). Software as a service (SaaS) is a particularly profitable business model that benefits from private equity.

By funding capital for start-ups and established companies, PE firms can innovate, scale, and compete on a global scale, driving advancement, industry consolidation, and business expansion.

Experience Private Equity Value Creation with Teoh Capital

In 2023, private equity is one of the most significant contributors to economic growth — especially from software and technology businesses. In the first quarter of 2023, tech-focused deals comprised about 50% of all PE activity by value. If you want to be a part of this value-based growth, consult Teoh Capital. We are the leading private equity investment firm in Sydney, Brisbane, Melbourne, and more locations across Australia, investing in growing software businesses and long-stand brands.

With decades of success growing technology businesses, Teoh Capital prioritises sustainable growth over ‘growth at all costs’. We’re a family-run business that offers unbeatable certainty and transparency, with a flexible investment structure that promises capital in and capital out, making us the best choice for value creation in a company. Reach out today to work with our founding family’s expert minds and experience enduring growth, efficient management, and permanent capital.

Related Articles

Why Family Businesses Are Ideal for Private Equity

Private equity firms invest in companies to enhance their value and improve their prospects for capital growth. Many firms invest in growing businesses and long-standing brands, but one often overlooked investment target is family businesses. Family businesses run with long-term intentions and a strong...

The Role of Private Equity in Merger and Acquisition Transactions

Mergers and Acquisitions (M&A) transactions are a common and often essential component in corporate growth. Empowering the rapid expansion and scaling of companies through strategic partnerships, private equity firms play a crucial role in facilitating M&A transactions for private companies. In this...

Management Buyout vs. Private Equity

Should you consider a Management Buyout from within your company? Or go with external Private Equity, Strategic buyers or a Founder Investor? There are pros and cons with each approach, and the more time you allow to consider your options.