Private equity investing has increasingly entered the public consciousness over the last decade. Thanks largely to the emergence of the Silicon Valley tech bubble the advent of terms such as “Unicorns” to describe privately-owned start-ups with a valuation north of $1-billion, private equity investing has well and truly entered the mainstream.

According to the latest data from Preqin, the global private equity market surpassed 4.74-trillion USD at the beginning of 2021. Whether you’re an experienced investor or just getting started, this article will provide you with a solid foundation for understanding the basics of private equity and its changing role in the financial world by addressing the following:

- What is Private Equity?

- How Does Private Equity Work?

- What is the Goal of Private Equity?

- What is a Private Equity Firm?

- What is the Difference between Private Equity and Venture Capital?

What is Private Equity?

Before we jump into how private equity works, let’s first answer the question of “what is private equity?”. In simple terms, private equity describes an investment partnership where one companies buys and manages another company before selling it. Private equity firms will typically acquire a majority ownership stake in a company with the intention of using their experience and network to increase its value before selling it for a profit.

How Does Private Equity Work?

Private equity involves the acquisition of a private company or asset by an investment firm. Once the private equity firm takes control of the company, they work to increase value through various initiatives such as restructuring, introducing new product ranges, or expanding into new markets.

Private equity firms use their connections, experience, and marketing reach to improve the operational efficiency and profitability of the company that they invest in. Because they boast significant cash and personnel resources, they are usually able to expedite the process of expanding and growing an established business.

Businesses that need help scaling operations or are looking to expand without taking on additional debt will often seek private equity funding.

What is the Goal of Private Equity?

The goal of Private Equity investing is to generate higher returns for investors and the companies that they invest in. PE investing also allows investors to take an active role in company management and operations in order to extract the maximum value from their investment. This may include investors working across activities such as networking, day-to-day operations, marketing, or lead generation.

Private Equity deals are typically very flexible when it comes to structuring deals, which makes them attractive to seasoned investors. PE has become a popular investment vehicle for institutional and high-net worth individuals that are looking for higher returns and more control than typical, passive investment strategies.

By investing in private companies, investors have the potential for significantly higher returns than public markets, as well as access to unique and exciting opportunities that are not available in public markets.

What Is a Private Equity Firm?

A Private Equity Firm or a PE Firm is an investment firm that uses the funds of investors to purchase and manage other companies or assets that have the potential to generate revenue. Private equity firms will typically specialise in different verticals or types of investments.

By investing in companies at various stages of development and growth, private equity firms can generate returns for their investors by increasing the value of their investment (a company or asset). Private equity firms typically employ a range of highly skilled professionals such as bankers, analysts, or IT specialists that are responsible for deploying strategic solutions on behalf of their investors.

In addition to injecting capital, PE firms may provide management advice and access to other services or intellectual property that can help businesses to achieve success. Private equity firms will often specialise in a niche or area of expertise where they can leverage industry knowledge and solutions that can fast-track growth.

Private equity firms provide value for their investors and the companies that they invest in. Capital, knowledge, resources, and experience helps to make their investments more profitable, which is beneficial to their investors and the companies that receive investment.

Private Equity vs. Venture Capital – What’s the Difference?

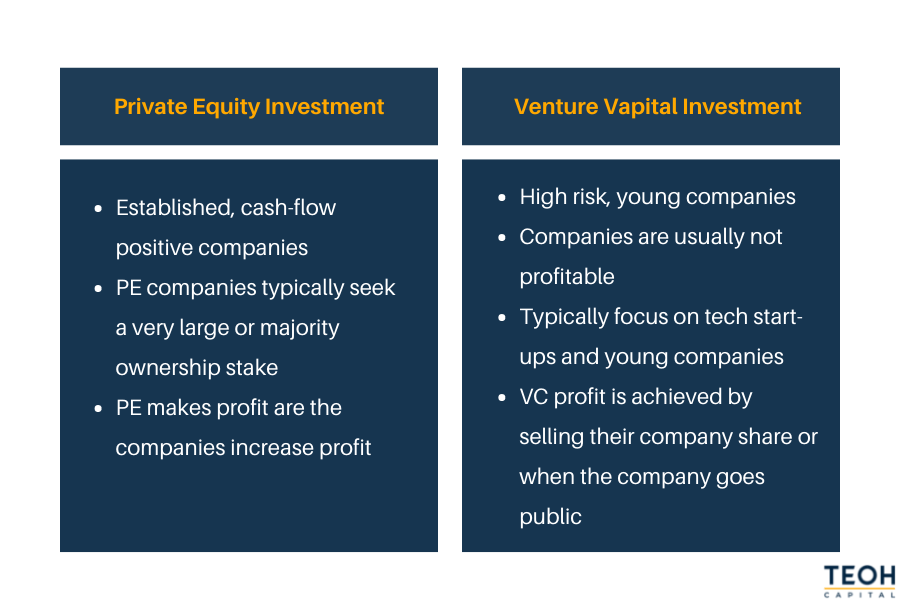

Private equity and venture capital are two distinct types of investments. While the two terms are often used interchangeably to describe capital investment in a company, there are some important differences that set them apart.

Perhaps the greatest difference between private equity and venture capital is the level of risk that is involved in each type of investment. Venture capital is a high-risk investment in a young company, on the other hand, private equity is an investment in an established (3+ years) company with a proven track record of sales and profitability.

Private Equity Investment

- Established, cash-flow positive companies

- PE companies typically seek a very large or majority ownership stake

- PE makes profit are the companies increase profit

Venture Capital Investment

- High risk, young companies

- Companies are usually not profitable

- Typically focus on tech start-ups and young companies

- VC profit is achieved by selling their company share or when the company goes public

Final Thoughts

Ultimately, the success of a private equity investment comes down to careful analysis, sound decision making, and a commitment to predetermined goals.

Private equity firms provide an important opportunity for businesses that require capital and expert assistance to reach new heights. While the risks for investors are significant, the upside of PE investing can be significant and rewarding for both parties. Private equity offers a unique opportunity to unlock the full potential of an organisation through capital and expert guidance. For more information on the Teoh Capital private equity firm and our services across Sydney, Melbourne, and Brisbane, get in touch with our friendly team today.

Related Articles

Why Family Businesses Are Ideal for Private Equity

Private equity firms invest in companies to enhance their value and improve their prospects for capital growth. Many firms invest in growing businesses and long-standing brands, but one often overlooked investment target is family businesses. Family businesses run with long-term intentions and a strong...

What you need to know about private equity

Fundraising is often daunting for business owners. Raising capital can allow the company to flourish, but finding the right investment partner can be time-consuming and difficult. Asking for money might be outside your comfort zone. Not asking for it can keep you small.

Seller beware: 7 things to look out for when selling your software company

When it’s time to move on, you can feel excited about the next stage. You might be retiring, taking up an exciting career shift or starting another business from scratch. The urge to move on quickly can pull your focus away from important details. And these can lead to mistakes.