Private Equity (PE) and Venture Capital (VC) are two channels of investment that are often (incorrectly) used to describe private capital investments into companies at various stages of their business lifecycle. However, in spite of the confusion that exists, there are some very stark differences between private equity and venture capital investment.

Private Equity and Venture Capital firms invest in different types of companies at different stages of their business lifecycle, commit different amounts of money, and hold equity in different ways when they invest in companies.

Topic Overview

- Private Equity Overview

- Venture Capital Overview

- Well Known PE Backed Companies

- Well Known VC Backed Companies

- Similarities Between PE & VC

- Key Differences Between PE & VC

- Pros & Cons of Private Equity

- Pros & Cons of Venture Capital

Private Equity Overview

Private equity investing involves the investment and acquisition of privately owned companies. Private equity firms (like Teoh Capital) leverage funds from institutional investors or high-net-worth individuals to acquire and invest in privately owned companies.

Typically, PE firms will have a specialty or niche where they have proven experience. Depending on the nature of the business, this may involve improving the operational efficiency of a business, streamlining processes, identify waste and inefficiency, or even expanding the business into new markets. Through these actions, PE firms aim to improve increase profitability and drive bottom-line growth.

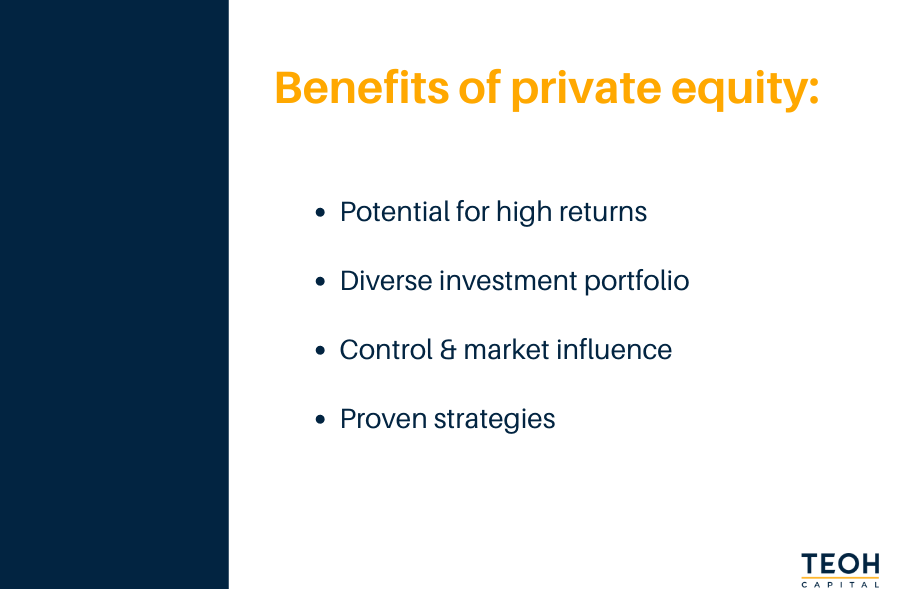

Private equity can be appealing to institutional investors and high-net-worth individuals for a number of reasons including:

- Potential for high returns: PE investing can be extremely lucrative. By acquiring a stake in established, already profitable companies and implementing proven strategies, PE firms can drive significant growth and, therefore, profitability for their investment.

- Diverse investment portfolio: As we have seen in the second half of 2022, traditional investment markets can be extremely volatile. By diversifying investment into established, profitable companies, PE firms can effectively circumnavigate traditional market volatility.

- Control & market influence: Private equity investors have significant control and influence in the companies in which that invest. This control means that they can shape the direction of the company and make tough business decisions that business founders and internal management teams may struggle to make.

- Proven strategies: As we mentioned at the top, niche experience means that PE firms can often (quickly) identify operational inefficiencies and implement proven techniques to streamline business operations and maximise profitability.

Venture Capital Overview

Venture capital investing involves providing financial support for start-ups or growing businesses with the opportunity for large, long-term returns if they are successful. VC investing has become somewhat of a buzzword over the last decade with the runaway success of tech companies like Facebook, Airbnb, Uber. The bean-bag strewn offices associated with tech start-ups have become the unofficial imagery that many associate with VC investing.

VC firms will typically invest in businesses during the very early stages of their business lifecycle when they have a high potential for growth, in lieu of proven, profitable revenue streams. Venture capital investing involves a high level of risk as many start-ups do not achieve the same level of growth of success that is projected in those early days. The flip side of the ‘risk’ coin is that venture capital investment can yield significant ROI when successful.

Venture capital investment is a key source of funding for start-ups and small businesses that have a significant opportunity for growth but lack the capital to get things off the ground. VC funding provides businesses with access to capital and resources that facilitate growth at a stage where the business cannot rely on its own revenue streams.

Similarities Between Private Equity & Venture Capital

Like we mentioned, private equity and venture capital are sometimes used interchangeably to describe any type of private investment into privately owned companies. While we now know that this is not the case, there are a number of similarities between PE and VC that are worth mentioning.

Some of the similarities between PE and VC include:

- Ownership status: VC and PE firms will typically invest in companies that are not publicly traded.

- Due diligence: both VC and PE firms will do extensive due diligence on the companies that they invest in before making any sort of commitment.

- Drive for profitability: both VC and PE seek to improve the profitability of the companies that they invest in through an injection of capital and resources

- Role in the company: both venture capital and private equity firms will take an active role in the management of the companies that they invest in. This involvement ensures that their investments grow and make the best business decisions.

- Niche focus: VC and PE firms will typically have an area of expertise such as tech, software, or finance.

Overall, private equity and venture capital investments are similar in the sense that they provide capital and access to resources in exchange for an ownership stake in a company. Once invested, both firms aim to maximise the profitability of their investment through operational and financial optimisation.

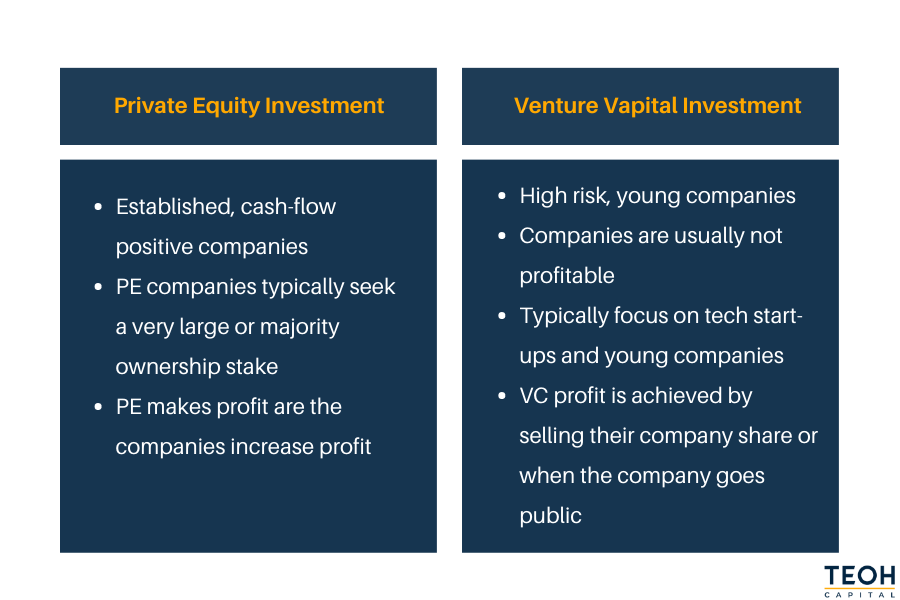

Key Differences Between Private Equity & Venture Capital

While venture capital and private equity companies share some similarities, there are some important differences that separate the two types of investments.

Some of the key differences between PE and VC include:

- Stage of investment: VC firms will typically invest in companies at a very early-stage of their business lifecycle. Conversely, PE firms tend to invest in mature companies with established proof of concept in the form of positive revenue streams.

- Level of risk: VC investment is high-risk with a high potential for return. Because these companies are usually in a “start-up” phase it means that they require a high-level of financial input to execute on their business strategy. On the other hand, PE firms deal with stable, mature companies with a proven track record of success.

- Investment timeline: The investment timeline for VC and PE investment can be vastly different. Because VC investing means backing young companies, it means that the timeline for positive returns can be extremely long.

- Level of involvement: VC investors will take a very active role in their investments providing support, guidance, and expertise to facilitate growth. PE investors will still provide these resources, but usually at a lower level.

- Exit strategy: For VCs, the exit strategy will usually centre around an initial public offering (IPO) and taking their investment public. On the other hand, private equity firms will typically exit their investments following the sale of the company to another firm or a merger.

Private Equity (PE) vs Venture Capital (VC) – Which Is Best?

So, now that you know the differences between private equity investment and venture capital investment, you may be wondering which is the best type of investment model.

The truth is, there is no one-size-fits all answer to this question. The answer largely depends on the type of company that you have, the stage that you are at in your business lifecycle, and your long-term goal for the business.

As we covered above, PE firms and VC firms invest in businesses at different stages of their lifecycle. Choosing between PE and VC investment will come down to your business age, short and long-term goals. Both types of investment can be beneficial depending on the stage that your business is at, so it is worth applying the above information to your business model to see which type of private investment would be most suitable.

Related Articles

SaaS Funding: Capital Growth Options for Software Companies

There’s no doubt about it - software as a service, or 'SaaS', is flourishing, becoming one of the most prevalent business models to emerge over the last decade. And as more tech-businesses continue to develop cloud-based solutions, many require funding for product development, marketing, and the resources...

How Does Private Equity Create Value in a Company?

The business landscape in 2023 and beyond can be overwhelmingly competitive — and that’s where private equity (PE) firms can make a difference. Over the past few years, private equity value creation has become a critical business contributor. An expert private equity firm can provide value and capital growth...

Developing an Exit Plan

Developing an exit plan. Ideally, you’ll sell your business at its peak. Too often, business owners don’t look far enough ahead. They don’t read the market effectively and panic-sell once their business is tanking. You want to maximise returns.