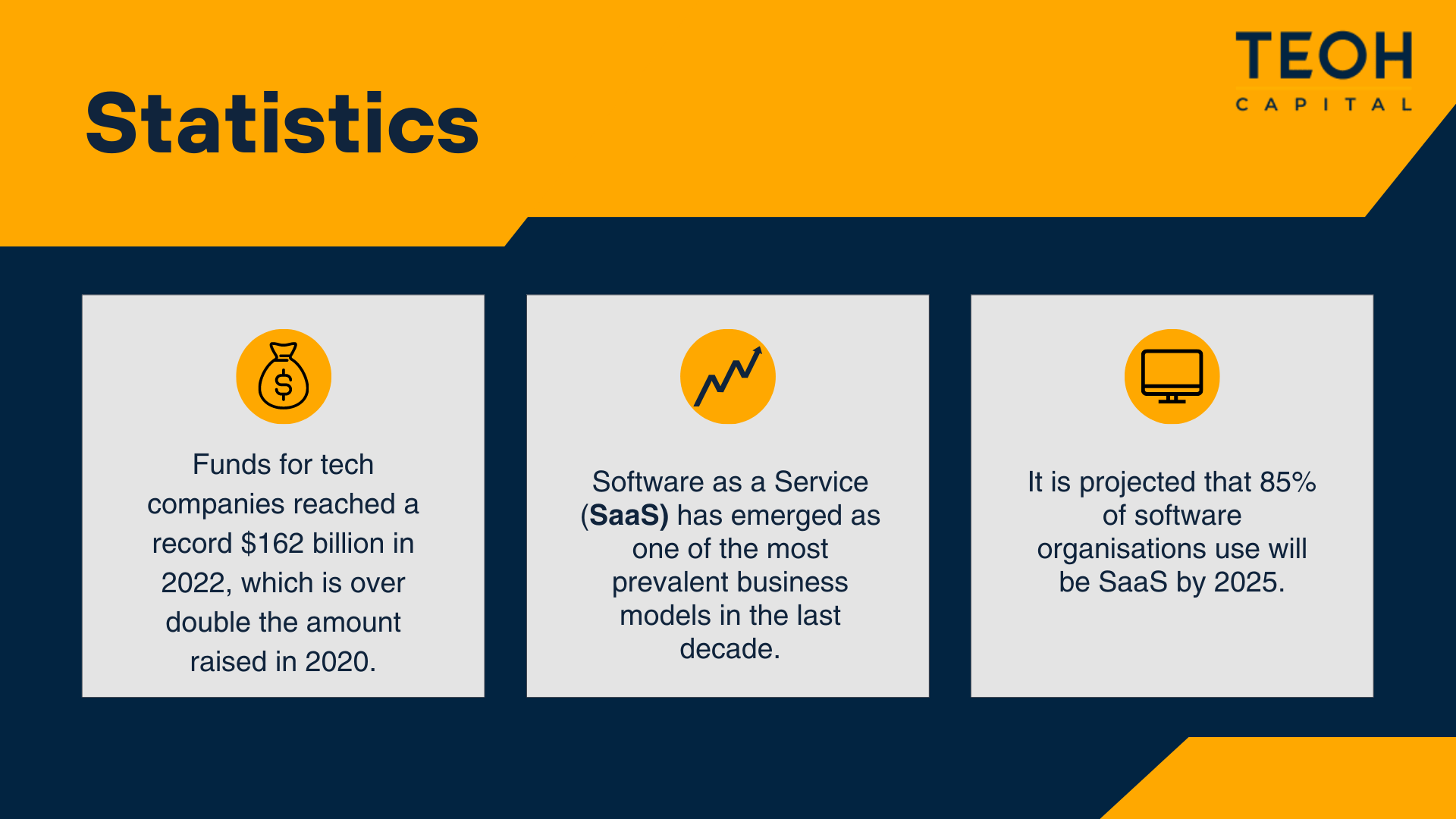

There’s no doubt about it – software as a service, or ‘SaaS’, is flourishing, becoming one of the most prevalent business models to emerge over the last decade. And as more tech-businesses continue to develop cloud-based solutions, many require funding for product development, marketing, and the resources necessary to scale. The amount of capital raised by funds for tech companies in 2022 reached an unprecedented high of $162 billion, more than double the $73 billion recorded in 2020 (Pitchbook, 2023).

The surge in investments for SaaS companies has normalised various types of funding for tech companies – start-ups and long-standing brands. SaaS companies can benefit from traditional funding methods like Venture Capital and Private Equity and revenue-based financing routes like crowdfunding.

With the diversity and range of SaaS funding options, choosing how to grow and expand your business can be overwhelming – on top of what can already be a complicated process in developing a SaaS product. In this article, we’ll take a look at the following points which will help you decide on the right funding option for your business:

- Types of SaaS Funding Options

- How to Choose the Right SaaS Funding Option for Your Business

- Tips for Successfully Raising SaaS Funding

- Common Mistakes to Avoid When Raising SaaS Funding

Types of SaaS Funding Options

Venture Capital (VC)

Venture Capital is a form of financing investors provide to start-up companies in exchange for equity. VC funding provides SaaS businesses with rapid capital growth. These businesses can use this funding to grow and develop their operations successfully.

Venture Capitalists are usually wealthy investors, investment banks, and large financial institutions. They bring valuable advice and industry connections to the business they fund. Unfortunately, Venture Capitalists often ask for a high return on their investments. This can put a lot of pressure on SaaS businesses, who may feel they must be hugely successful in a relatively short time to make good on the VC’s investment. The VC’s demands and the business’s structure may also generate conflict.

Private Equity

Thanks largely to the emergence of the Silicon Valley tech bubble, private equity investing is now a major proponent for SaaS funding.

Private Equity is an alternative form of investing in companies. Private equity firms invest in businesses that have a proven record of success and a strong potential for capital growth. Private equity investors usually involve themselves in company management and operations, as they have an interest in making the business as profitable as possible to make good on their investment when they eventually sell the company.

Private Equity firms usually have high capital, so they are an excellent source of large funds. The high level of active involvement that PE firms take can also help to increase efficiency in company management. However, PE firms may expect returns on their investment within a certain time frame and require a significant ownership stake in the company. PE investments are long-term solutions involving a series of financial models that leverage debt to increase returns.

Angel Investors

Angel Investors invest capital in exchange for equity ownership. Angel Investors are usually high-net-worth individuals who invest from their own pocket rather than investment funds. They may also provide mentorship to the company’s team.

Like Venture Capitalists, Angel Investors can provide valuable advice and funds to businesses, especially those just starting. However, they may be less knowledgeable in the industry and have fewer connections than Venture Capitalists. They may also be less willing to take risks on companies that have an uncertain future.

Crowdfunding

SaaS businesses can raise capital through groups of individuals on online platforms such as Indiegogo, SeedInvest Technology, and StartEngine. The rules of these platforms may fall into one of four categories:

- Equity crowdfunding — investors provide you with funding as long as you sell them part of your business

- Donation crowdfunding — a simple donation page where nothing needs to be paid back

- Debt crowdfunding — businesses can borrow money from individuals and pay it back with interest, like a business loan

- Rewards crowdfunding — funders are offered products and rewards in exchange for their donations, with different tiers for more expensive donations and greater rewards

Crowdfunding can create a valuable connection between the funders and the business and provide the company with a large amount of capital. However, crowdfunding efforts can be challenging to manage and promote. Additionally, due to their public nature, they risk exposing the company’s intellectual property to competitors.

Self-Funding

Companies may use their own personal savings, credit, or loans to generate capital. This can be a worthwhile investment for companies with low costs and few employees. It also gives the company complete control over its business. It also eliminates the debt that may accrue from the other funding options. The downside is the high risk of investing personal finances into professional ventures. It may also limit the company’s potential capital growth if the amount invested is too low.

How to Choose the Right SaaS Funding Option for Your Business

With all the different options and their respective pros and cons, reaching the right decision takes work. Make sure to first and foremost identify your business goals and funding needs. What do you need capital for, and how much? What are the costs of your operations, products, marketing, and workforce? Once you have an estimate of how much you need, you can narrow down the wide range of options.

Next, understand the advantages and disadvantages of each funding option, as detailed above. Think carefully about the level of investor involvement, debt or repayment terms, and overall cost and effort.

Some funding options come with more significant risks than others. Depending on your business’s risk tolerance, you may be safer going with a Private Equity firm rather than a Venture Capitalist. Depending on how much management control you desire, crowdfunding or personal funding could help you to maintain autonomy and creative control. Make sure you consider not just the risk to yourself and your business but the risk that the investor(s) will be exposed to by funding you.

When in doubt, seek advice and guidance from industry experts. If you have access to financial advisors or lawyers, they can provide you with helpful and valuable insight that can help you to make a safe and informed decision.

Tips for Successfully Raising SaaS Funding

Before you approach anybody or invest money, building a robust and detailed business plan is essential. Outline your products or services, target market, and growth strategy.

Once you have a plan, you can identify and reach out to potential investors or consider other funding options. Make sure investors align with your business goals, ethic, and values.

While you’re doing this, make sure to network and build relationships in your industry. This helps you gain both visibility and credibility.

Effectively communicate your business’s value proposition to investors. Set your business apart from competitors and run with your strengths; prove there is a market for the products or services your business will provide.

Following these tips will increase your chances of raising the funding you need for your business to grow and profit.

Common Mistakes to Avoid When Raising SaaS Funding

As mentioned previously, having a firm plan is crucial when considering raising funding for your business. Raising SaaS funding is a difficult, complex process that can only be completed with adequate preparation. A common mistake is to focus too much on funding options before making a solid business plan.

Another common mistake to be avoided is overlooking the importance of due diligence. Before any investment can be made, a potential investor must comprehensively investigate the business and evaluate its financial, legal, and operational structure. However, as its key purpose is to identify and assess the risks associated with the investment, due diligence falls to both the investor and the business. Both parties must ensure they are content with the risk and prepared to take responsibility should there be any issues.

It’s also a mistake to focus solely on raising funds. Even if your business receives a significant investment, you can only make sufficient returns on that investment if you have a sustainable and profitable business that can generate long-term interest and value. Before raising funds, put in the hard work to ensure your business will be successful.

Finally, it’s essential to communicate effectively and frequently with investors. They want to know what you’re doing with the money they raised for you. Provide regular updates and honest, transparent reports on business performance and progress. Avoid poor or dishonest communication; this is an unfair way to pay them back for their trouble.

Final Thoughts on SaaS Funding and Where You Can Start

It’s important to choose carefully when deciding on SaaS funding for your business. Evaluate your business goals, funding needs, and risk tolerance, and consider the pros and cons of the different fundraising methods. Be sure to seek expert advice and guidance rather than rushing into a plan. The source of your financing can make or break your business, so prioritise a solid business structure and strategy with plans A, B, C, and D so you’re prepared should anything go wrong.

We hope this article has helped you in your search for funding, and we wish you the best of luck with your business. The future of SaaS funding is bright and will only continue to get brighter as the demand for software-based services grows. Here at Teoh Capital, we invest in developing software businesses as well as long-standing brands, so if you think we can help you with your business, get in touch. Remember to stay prepared, informed, and adaptable, so your SaaS business may find capital growth and success in the modern world.

Related Articles

Why Family Businesses Are Ideal for Private Equity

Private equity firms invest in companies to enhance their value and improve their prospects for capital growth. Many firms invest in growing businesses and long-standing brands, but one often overlooked investment target is family businesses. Family businesses run with long-term intentions and a strong...

Seller beware: 7 things to look out for when selling your software company

When it’s time to move on, you can feel excited about the next stage. You might be retiring, taking up an exciting career shift or starting another business from scratch. The urge to move on quickly can pull your focus away from important details. And these can lead to mistakes.

6 Common Mistakes When Selling Your Tech Company

Everything looks rosy and you’re ready to sell. This is the moment you’ve worked so hard for, and all the sacrifice is about to pay off. One or more potential buyers is knocking at your door, and you’re excited about what’s about to unfold. Here are 6 common mistakes that people make.